Bounce Bit Trading Coins: Profitable Techniques

Bounce Bit Trading Coins: Profitable Techniques

Bounce Bit Trading Coins In the dynamic world of cryptocurrency, Bounce Bit Trading Coins have emerged as a lucrative opportunity for investors and traders alike. Navigating the complexities of this digital asset requires a blend of strategic insight and practical techniques. In this article, we delve into the most effective methods to maximize your profits with Bounce Bit trading coins.

Understanding Bounce Bit Trading Coins

Bounce Bit Trading Coins represent a cutting-edge development in the crypto market, designed to offer unique advantages to savvy investors. These coins leverage advanced blockchain technology to provide secure, transparent, and efficient transactions. Bounce Bit Trading Coins Understanding their fundamental features is crucial for anyone looking to capitalize on their potential.

Key Features of Bounce Bit Trading Coins

- Decentralization: Unlike traditional currencies, Bounce Bitcoins operate on a decentralized network, ensuring that no single entity controls the market.

- Security: Advanced cryptographic techniques protect transactions, making Bounce Bit coins highly secure against fraud and hacking.

- Transparency: The blockchain ledger provides a transparent record of all transactions, fostering trust and accountability.

- Efficiency: Transactions with Bounce Bitcoins are processed swiftly, reducing the time and cost associated with traditional banking methods.

Profitable Techniques for Trading Bounce BitCoins

To thrive in the Bounce Bit trading ecosystem, adopting a strategic approach is essential. Bounce Bit Trading Coins Here are some of the most effective techniques to enhance your profitability:

1. In-Depth Market Analysis

Conducting thorough market analysis is the cornerstone of successful Bounce Bit trading. Utilize both fundamental and technical analysis to gain insights into market trends, coin performance, and potential price movements.

- Fundamental Analysis: Evaluate the underlying factors that affect the value of Bounce Bitcoins, such as technological developments, regulatory news, and market sentiment.

- Technical Analysis: Use chart patterns, indicators, and historical price data to predict future price movements. Bounce Bit Trading Coins Tools like Moving Averages (MA), Relative Strength Index (RSI), and Fibonacci retracements are invaluable in this regard.

2. Diversification

Diversifying your investment portfolio is a proven strategy to mitigate risk and enhance returns. In the context of Bounce Bit trading coins, diversification involves spreading your investments across various digital assets to avoid significant losses from a single underperforming asset.

- Portfolio Diversification: Invest in a mix of established cryptocurrencies and promising new coins to balance risk and reward.

- Sector Diversification: Explore different sectors within the cryptocurrency market, such as Deify (Decentralized Finance), NFTs (Non-Fungible Tokens), and blockchain infrastructure projects.

3. Leveraging Automated Trading Bots

Automated trading bots can execute trades on your behalf, based on predefined strategies and market conditions. These bots are particularly useful for Bounce Bit trading, where market volatility can present both opportunities and risks.

Algorithmic Trading: Use bots programmed with sophisticated algorithms to identify and capitalize on trading opportunities in real time.

Risk Management: Implement risk management protocols within your trading bots to prevent excessive losses and protect your investment.

4. Staying Informed and Updated Bounce Bit Trading Coins

The cryptocurrency market is highly dynamic, with rapid changes influenced by various factors. Staying informed about the latest developments is crucial for making timely and informed trading decisions.

- News Aggregators: Use news aggregators and crypto-specific news platforms to stay updated on market trends, regulatory changes, and technological advancements.

- Social Media: Follow influential figures and communities on platforms like Twitter, Reedit, and Telegram to gain insights and sentiment analysis from the crypto community.

5. Practicing Effective Risk Management

Effective risk management is vital to ensure long-term success in Bounce Bit trading. This involves setting clear risk parameters and sticking to them, regardless of market conditions.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your assets when they reach a certain price, preventing further losses.

- Diversified Strategies: Employ a mix of short-term and long-term forex trading strategies to balance potential gains with risk exposure.

Advanced Strategies for Maximizing Profits

For experienced traders, advanced strategies can provide an edge in the competitive Bounce Bit market. These strategies require a deeper understanding of market dynamics and a higher risk tolerance.

1. Swing Trading Bounce Bit Trading Coins

Swing trading involves taking advantage of short-to-medium-term price movements within the Bounce Bit market. This strategy requires a keen eye for spotting trends and the ability to act quickly on market signals.

- Trend Analysis: Identify and follow market trends to capitalize on upward and downward price swings.

- Entry and Exit Points: Determine optimal entry and exit points based on technical indicators and market sentiment.

2. Arbitrage Trading

Arbitrage trading exploits price differences of Bounce Bit Trading Coins across different exchanges. By buying low on one exchange and selling high on another, traders can secure risk-free profits.

- Exchange Monitoring: Continuously monitor multiple exchanges for price discrepancies.

- Speed and Efficiency: Ensure quick execution of trades to capitalize on fleeting arbitrage opportunities.

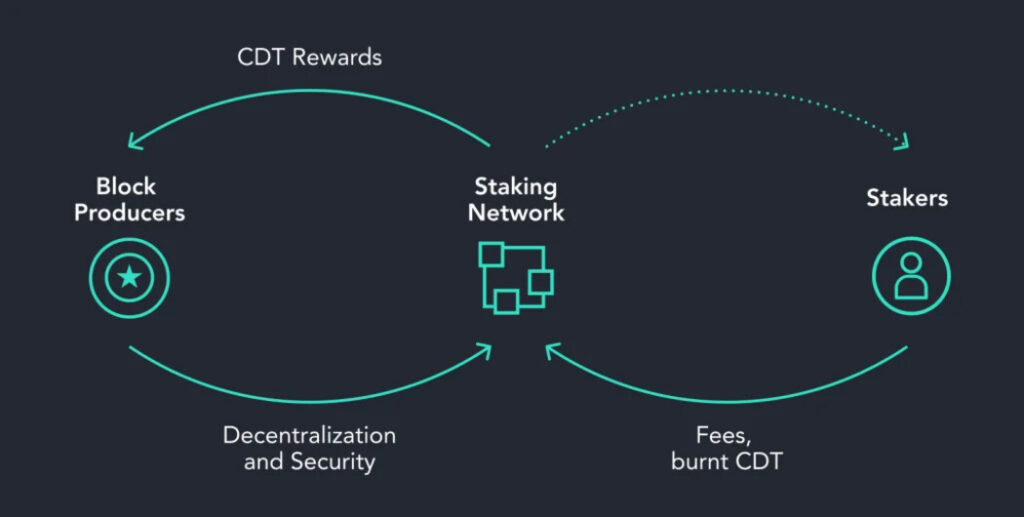

3. Staking and Yield Farming Bounce Bit Trading Coins

Staking and yield farming involves locking up your Bounce Bitcoins in a network to earn rewards or interest. These methods provide a steady income stream and can significantly enhance your overall returns.

- Staking Rewards: Participate in staking programs offered by various platforms to earn rewards for validating transactions.

- Yield Farming: Engage in yield farming by providing liquidity to decentralized exchanges (DEXs) and earning interest on your locked assets.

Conclusion

Mastering the art of Bounce Bit Trading Coins requires a blend of analytical skills, strategic planning, and continuous learning. By employing the techniques outlined in this article, you can navigate the complexities of the Bounce Bit market and maximize your profitability. Stay informed, diversify your investments, and practice effective risk management to thrive in this dynamic and exciting field.

Check it Here: Affiliate Marketing Automation